As it turns out, they’re also packed with defining moments that will shape the rest of your life. And while it’s usually very difficult for young people to think about things like planning for retirement and investing in life insurance, the truth is that those AARP discounts are closer than you might think. So if you can learn these important things about money and finance now, in the future you’ll be happy that you did, and probably a lot richer too.

1. Pay Yourself First

Paying yourself first means taking a portion of your earnings and putting it into a savings account or investment that can then work to earn you more money, all while you sleep. The reason why this is so important is because when you’re saving money it grows in relation to the interest it accrues, so the more money you have to save and the longer you’re saving, the more you can take advantage of this extra “free” money. Alternatively, by not saving you’re also losing the money that could be gained in interest. That’s why it pays to learn how to pay yourself first.

2. Learn how to Leverage the Power of Compound Interest

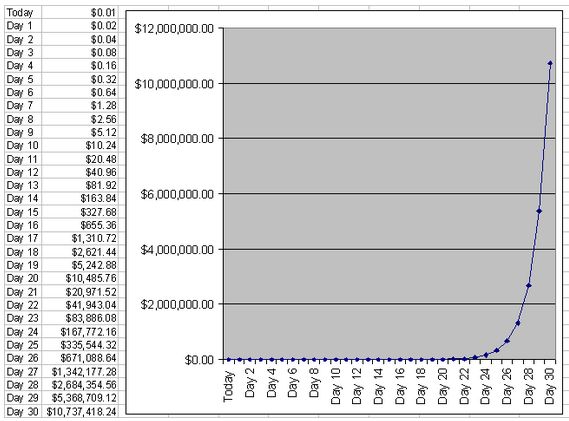

In his book The Slight Edge, Jeff Olson explains the power of compounding with a penny. A penny doubled each day for thirty-one days is greater than one million dollars today, he explains, and actually adds up to $10,737,418.24! Photo credit Cviko Vidakovic Twenty-somethings have the best opportunity to take advantage of compounding because of the magic of time and the power that compounding gains as it grows. Unfortunately, many 20-somethings ignore this wealth-making practice and lose valuable opportunity in the process.

3. Grow Your Financial Education

4. Know Your Credit Score and Keep it Up

As credit scores go, anything below 500 is a red flag and, just like your grades in school, it’s a lot easier to slide down than it is to bring back up, so pay attention. For additional queries and your free credit score, use CreditKarma, Credit.com, or Bankrate.

5. Live Within Your Means

Living within your means may look like skipping the movies on the weekends, trading your daily Starbucks for a homemade cup of coffee, or forfeiting that shopping spree in favor of recycling your wardrobe for a few seasons. However, when you practice this without reliance on debt, you give yourself a better chance to build a strong financial base. You might not think so now, but if you don’t put down that iced latte, you may be kicking yourself in the future.

6. Learn to Use Discipline to Manage Income and Expenses

Through a series of parables the author, George Clason, relates the common experiences of poor money managers and outlines disciplines that lead to lifelong riches and wealth. So imperative to financial health are the disciplines of managing income and expenses that these lessons serve as the foundation of the entire book. Unsurprisingly, failure to have a financial plan with these in mind is the number one regret of people when they reach retirement. Luckily for you if you’re in your 20s, it doesn’t have to be yours.

7. Learn to Manage Your Emotions Around Money

There’s no denying that having money (or not having it) comes with a lot of emotion. When we have it we’re happy (and often irrational), and when we don’t we’re sad. With each emotion come behaviors that can make or break our financial stability for the future. Many a divorce, bankruptcy, and heart attack have been attributed to the stress that people feel around money that could have easily been avoided. Learning to manage your emotions with money is not only a good idea, it’s the thing that will help you to successfully navigate your way through the thousands of financial decisions you’ll need to make throughout your life, so it stands to reason that the better you can do this, the more money you’ll keep. While it may be easier said than done, there are always resources that can help you identify your level of emotional intelligence around money and work to improve it at the same time. Your twenties are a mixed bag full of fun experiences and new opportunities for growth. But if you can find a way to incorporate the seven practices above, you’ll not only thank yourself later, but even be able to afford to buy yourself an expensive treat! Noize Photography via photopin cc